An invoice, sometimes called a sales invoice or bill, is a document issued by a business to indicate a transaction, and to request payment for a product or service provided.

Invoices are an important part of any business. They help you get paid in a timely manner, keep track of your accounts, and when done right, help build long-term, trusting relationships with your clients by clearly presenting what work was done or product sold, the price, including tax or discounts, as well as when payment is expected.

That’s right – a proper invoice reminds your customer that a payment is due, specifies what goods or services are being charged for, and when you expect payment. Studies show that including those three elements on an invoice can increase your changes of being paid on time.

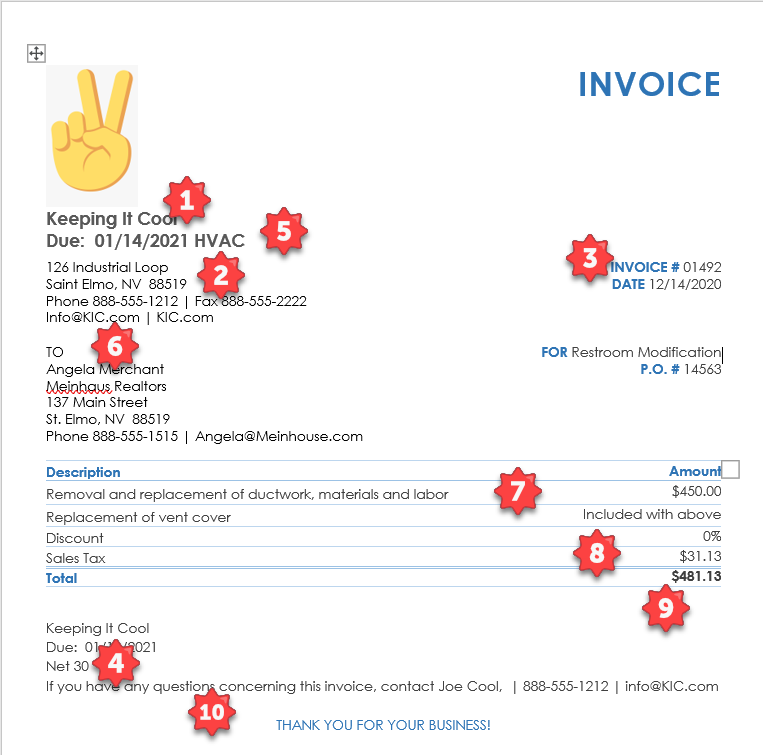

10 Elements of an Effective Invoice

1. The name of your business

Your business name is one of the most important elements of an official invoice template. It shows who you are and establishes your brand. Include your company logo for an extra professional touch.

2. Seller contact information

Adding seller contact information lets your clients know how to contact you if they have any questions about the invoice. It also allows them to contact you for future work.

3. Invoice number

To stay organized and make the tracking easier for tax season, it’s best to provide a unique and sequential invoice number for every invoice you send.

4. Payment terms

There are several types of payments terms small businesses use. These invoice payment terms depend on common practices of your industry, your relationship with the client, and your cash flow needs. For example, “Net 30” means that the invoice is due 30 days after the Invoice Date. Be mindful that some businesses may pay later than the stated due date, so you may want to account for a little extra time to avoid a cash flow gap.

5. Due date

The Invoice Date plus Payment Term Days give you the Due Date, which should be in plain English and easy to understand. Having a due date on the invoice is a tactful and professional way of making it clear to your client when they should pay. Setting up payment reminders can also help keep your customers on schedule to pay.

6. Bill to: Contact information

Who this invoice is intended for and their contact information.

7. Product or service details

Specify Description, Quantity, Rate, Amount and Subtotal. The more details you include on the invoice, the better. This way, your client will know exactly what they are paying for upon receiving the invoice.

8. Sales tax

Depending on your jurisdiction and type of business, the tax requirement can vary.Refer to your local tax bureau and include the appropriate tax amount on the invoice.

9. Discount

If you are offering a discount to a valued client, include the number here. This can be a percentage or actual amount.

10. Notes

A simple, personalized note will leave a good impression with the client and increase the chance of an invoice getting paid faster. You can also include payment instructions, warranty information, discount details or anything else relevant to the job.

So there you have it – the right way to structure an invoice. But for some of you, this still looks like a lot of work, am I right?

WorkFlow Assistants would be happy to build you a fill-in-the blanks template for a custom invoice.

We would also be happy to handle your billing and invoicing activities without you having to lift a finger. Give us a call.